Learn how offshoring improves your productivity and helps grow your business.

The comprehensive offshoring primer for business owners and managers.

Hear from some delighted clients, and see our staff and facilities for yourself.

All your questions answered. Even those you hadn’t thought to ask yet.

Recognitions, awards and important offshoring updates.

Build your team and see your savings immediately using this free tool.

Deep-dive into the details of offshoring. Research reports, fact sheets & more.

Can't find what you're looking for? View the full list of roles here.

How to overcome revenue cycle management healthcare challenges

Fitch Ratings is one of those organizations that, with a finely worded statement, can send a shudder through an entire industry. As one of America’s ‘Big Three credit rating agencies’, it is renowned for researching and analyzing the financial wellbeing of businesses and entire countries and its insights are widely considered a window into the reality of a sector.

Such was the case earlier this year when Fitch Ratings Senior Director Kevin Holloran declared in a presentation that this was going to be a “make-or-break year” for the hospital sector[1]. On the back of what he dubbed “the worst operating year we’ve ever seen”, he estimated that half of U.S. hospitals were not profitable for the full year and the future for many of them – especially rural facilities – looked bleak.

Such was the case earlier this year when Fitch Ratings Senior Director Kevin Holloran declared in a presentation that this was going to be a “make-or-break year” for the hospital sector[1]. On the back of what he dubbed “the worst operating year we’ve ever seen”, he estimated that half of U.S. hospitals were not profitable for the full year and the future for many of them – especially rural facilities – looked bleak.

"In an analysis of 80 nonprofit hospitals’ creditworthiness … Mr Holloran found significant declines in the 2022 period, resulting in Fitch applying a ‘deteriorating’, or negative, outlook for the hospital sector," Beckers Healthcare reported[2].

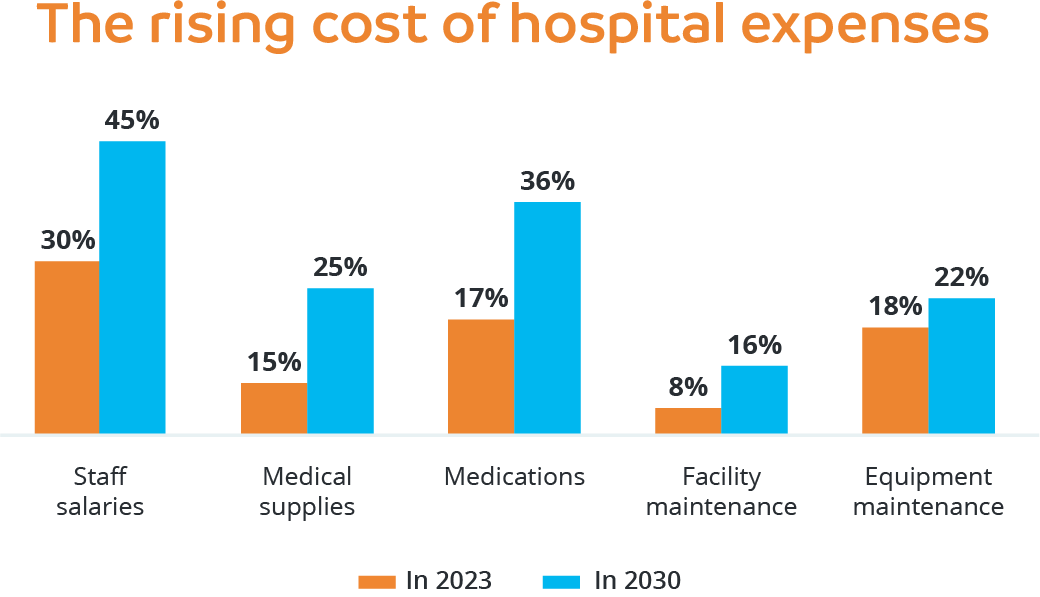

“Several financial challenges contributed to hospital margins suffering steep declines … including labor costs and staff shortages, inflation, higher cost of capital, investment losses and the end of federal pandemic-related funds.”

While hospitals do not represent all healthcare providers, a similar burden is weighing on other service providers. Under the ominous headline ‘The Gathering Storm’, research consultancy McKinsey & Co has predicted that annual U.S. national health expenditure will likely be $370 billion higher by 2027 due to the impact of inflation[3], while another study has found 78% of healthcare providers fail to collect patient fees of more than $1,000 within 30 days as people struggle to manage their medical debts[4].

Amid such financial pressures, effective revenue cycle management has never been more important for healthcare executives. From patient registration and insurance verification to claims submission, multiple tasks need to be completed to ensure hospitals and health services are promptly paid for the care they provide and this is where optimization of revenue cycle management comes to the fore.

What is revenue cycle management?

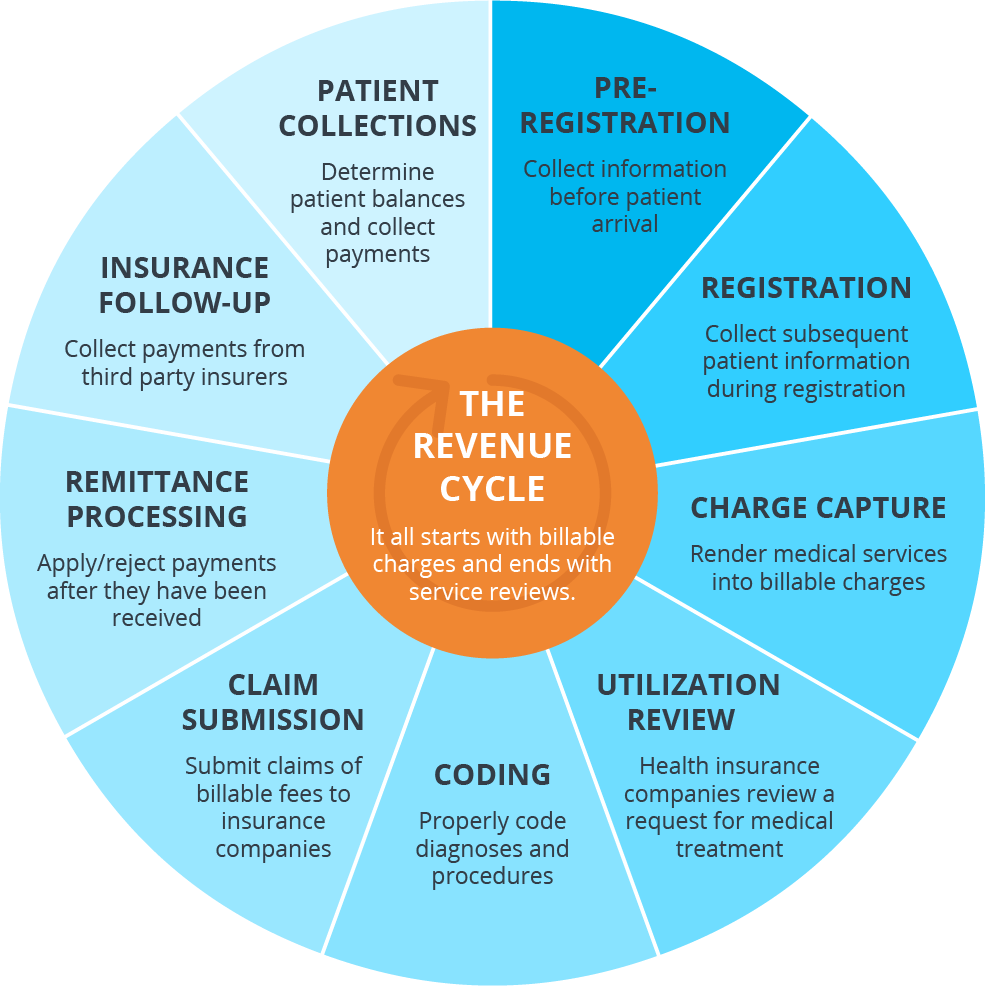

Revenue cycle management (RCM) is the act of managing a healthcare organization’s finances. From the first interaction with a patient to receiving the final payment, it encompasses all aspects of financial management including patient registration, medical billing and coding, insurance verification, claims submission and payment posting.

A quality RCM system has the potential to increase revenue and, in turn, boost a healthcare organization’s financial performance by streamlining processes, reducing administrative burden and ensuring accurate and timely reimbursement for services performed.

Source: The 9 Steps of Healthcare Revenue Cycle Management Explained (pmmconline.com)

Common challenges in healthcare revenue cycle management (RCM)?

In their ongoing bid to maintain strong revenue cycles, healthcare leaders need to be aware of the latest internal and external pressures that can impede their ability to achieve success.

- Increasing denials: one of the keys to quality cash flow is ensuring seamless payment of insurance claims but the reality is that denied claims are on the rise. An American Hospital Association study found that 89% of hospitals and health systems are seeing an increase in claims being denied[5], with payers using more sophisticated algorithms and technologies to identify potential issues. With increasingly complex criteria for claim submission also taking a toll, health leaders are being urged to tighten their mid-cycle processes to give themselves the best chance of avoiding the billing errors that can so seriously impede prompt receipt of insurer payments.

- Staff shortages: while the global skills shortage that inspired countless headlines in recent years has somewhat eased, many hospitals and health services are continuing to find it difficult to not only fill revenue cycle roles but keep them filled. This is partly driven by the societal trend towards remote work which means RCM specialists are no longer restricted to their geographic bases and can therefore choose from jobs across the country. Be it paying higher salaries to attract quality talent or relying on less experienced staff, health services are facing an RCM staffing conundrum.

- Regulatory compliance: when the No Surprises Act came into effect last year, federal regulators hoped patients would better understand healthcare costs in advance of care and be spared from unforeseen – or surprise – medical bills[6]. An unintended consequence has been a massive backlog of payments due to the huge number of claims that have been sent through the dispute resolution process, including more than 90,000 in less than six months[7]. Needless to say, this has placed a significant burden on health providers that were already struggling to stay on top of revenue cycle management.

- Technology hurdles: a few years ago it was estimated healthcare is a decade behind most industries in adopting new technologies[8], with the likes of patient security concerns, clinician reluctance and complex regulations all taking a toll. While there have been positive signs that this is changing, many hospitals and clinics continue to lack the capital or infrastructure required to invest in solutions and tools to realize revenue cycle management ambitions. Failure to embrace such technologies takes a toll on the ability to promptly collect payments, address denied claims and minimize data entry errors.

Source: Revenue Cycle Management Best Practices | ✅ [2023 Verified] (invensis.net)

How can outsourcing help optimize revenue cycle management?

Like many administrative duties, RCM is ideally suited to being sent offshore to outsourcing providers that specialize in delivering better collection rates, denial resolution efficiency and revenue growth.

- Improved healthcare: RCM is a time-consuming process that too often distracts clinicians and other staff from their primary purpose – patient care. Outsourcing the likes of billing, registrations and claims processing to quality offshore recruits enables hospitals and health services to dedicate more time to the frontline care that separates good from great in a sector where that is essential.

- Faster reimbursements: the saying goes that ‘time is money’ and that has rarely been more so than in the RCM space. Outsourcing providers have expertise in the accurate and efficient collection and verification of patient enrolments, insurance details and medical coding, which ultimately results in quicker turnarounds for claims submissions and payments.

- Better cash flow: supported by the latest software, offshore providers can improve cash flow for hospitals and health services by being constantly available to process claims and other revenue cycle documents. While in-house staffing is often impacted by vacations or sick leave, an outsourced team is committed to taking care of the likes of medical billing and insurance verification at all times, which ensures a steady revenue cycle.

- Reduced errors: quality outsourcing providers are renowned for nurturing highly skilled and experienced staff, who, in turn, take pride in performing their duties to the highest standards. Coupled with access to the latest technologies, they are likely to reduce the incidences of coding and other billing errors that can cause frustration and result in lost revenues for healthcare services.

Summary

Revenue cycle management may be a complex process but with the support of a professional and enthusiastic outsourcing partner, there are significant advantages to be gained. From maximizing financial potential to freeing up healthcare staff to focus on what they do best, there is a reason so many hospitals and health practices are looking offshore for their RCM needs.

Few industries have a passion for numbers quite like healthcare. Discover the key statistics that show why so many hospitals and health services are embracing outsourcing, along with insights into its growth drivers and market trends.

Reference:

[1] Hospitals faced 'worst operating year' ever in 2022: Fitch (beckershospitalreview.com)

[2] finvi-wp-july-2023.pdf (asccommunications.com)

[3] Transformative impact of inflation on the healthcare sector | McKinsey

[4] InstaMed’s Tenth Annual Report Finds High Consumer Demand for Digitization in Healthcare Payments | Business Wire

[5] Hospital Claim Denials Up for Most, Driven by Prior Authorizations (revcycleintelligence.com)

[6] No Surprises Act | Johns Hopkins Medicine

[7] Initial Report on the Independent Dispute Resolution (IDR) Process (cms.gov)

[8] Study: Healthcare Lags Other Industries in Digital Transformation, Customer Engagement Tech | Healthcare Innovation (hcinnovationgroup.com)

Popular posts

Newsletter sign up

Business growth and efficiency improvement hints and tips delivered direct to your inbox.

Related Posts

How outsourcing is helping boost telehealth services

Given the choice, there’s no doubt most of us would prefer to live in a world where we had never heard of COVID-19. A world in which more than 7..

Why healthcare outsourcing is on the rise

For more than two decades, Black Book Research has earned a reputation for having its finger on the pulse of the healthcare sector. Recognized as a..

How to implement outsourcing in healthcare

In a career spanning more than 30 years, Tina Wheeler has earned a reputation for having her finger on the pulse of the healthcare sector. A partner..