Reasons to outsource accounting and bookkeeping services

On the first day of 2024, Financial Executives International (FEI) shared a disturbing statistic with its members – more than 300,000 accountants and auditors had left their positions during the past two years1. The sun had barely risen on the new year and the collective of chief financial officers, chief accounting officers, treasurers and tax executives had received another stark reminder of the pressures confronting businesses of all shapes and sizes.

The article centered on a study that showed there had been a 17% decline in employed accountants and auditors since a peak in 2019, with retiring baby boomers, mid-career professionals (aged 45-54) and relative rookies (25-34) among the masses leaving the profession2. In the words of the FEI: "How do you meet your financial obligations, ensure compliance and drive growth when the expertise you need is in short supply?"

One option? Consider outsourcing.

What is outsourcing in accounting and bookkeeping?

Outsourcing in accounting and bookkeeping is the practice of partnering with external professionals or firms to handle specific or entire accounting and bookkeeping functions on behalf of a business. By delegating financial tasks to a specialist individual or team outside of one’s own organization, it allows businesses to focus on their core responsibilities and strategic initiatives.

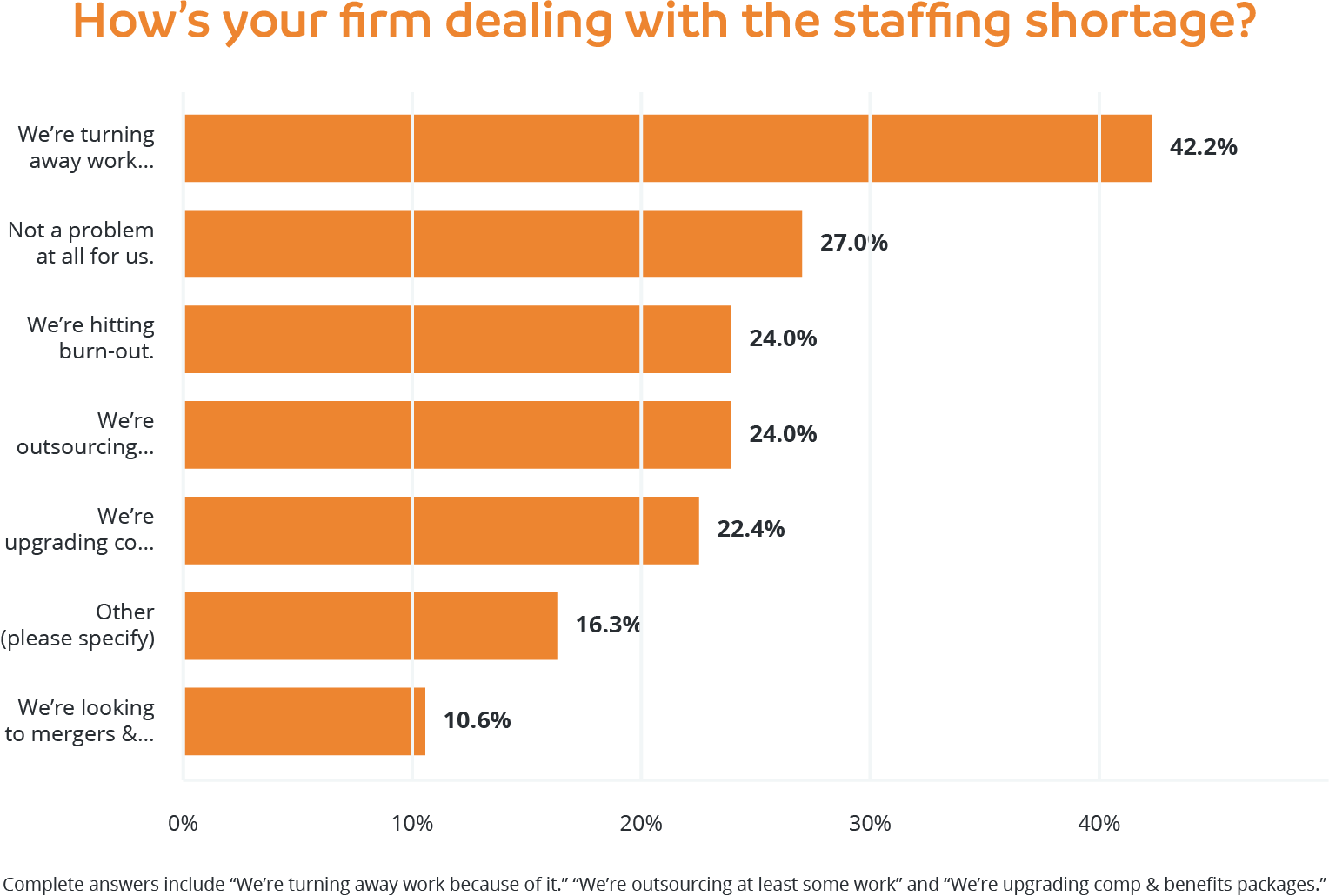

Source: SURVEY: 42% of Accountants Turn Away Work Over Staff Shortages - CPA Trendlines

How popular is outsourcing in accounting and bookkeeping?

Outsourcing accounting and bookkeeping processes have grown in popularity during the past decade. After a significant spike on the back of the global financial crisis3, even more businesses have embraced the practice in recent years due to advancements in cloud computing, online video conferencing and digital data. A variety of studies show that:

- Finance and accounting outsourcing is projected to reach $51 billion by 20264

- Accounting is the most commonly outsourced process among small businesses5

- 37% of small businesses outsource both accounting and IT services6

- Finance leaders consider 89% of accounting activities highly automatable7.

Reasons to outsource accounting and bookkeeping services

Outsourcing has long been an attractive business strategy and it is no different for organizations looking to improve accounting and bookkeeping efficiencies.

- Cost savings: partnering with a quality outsourcing provider in offshore destinations such as the Philippines can save businesses up to 70% on labor costs8. The combination of a lower cost of living and less need to pay for infrastructure such as office space and equipment is a proven winner, with businesses able to instead invest those funds into product research, marketing or increased production.

- Scalability: outsourcing accounting and bookkeeping services is an excellent way for businesses to increase or decrease staff based on business volume. By tapping into the resources of an outsourcing provider, there is no need for time-consuming recruitment campaigns or costly payouts when reducing team numbers. This flexibility is particularly valuable during accounting peak periods such as tax season and allows organizations to quickly adjust staff requirements in short timeframes.

- Access to expertise: it is one thing for a large company to invest in an in-house bookkeeper or accounting team. It is another for a small operator that is doing its best to survive on much tighter budgets. Outsourcing allows such businesses to access highly skilled accounting and bookkeeping professionals at a fraction of the cost they would pay onshore, with the likes of the Philippines generating 175,000 new Certified Practicing Accountants and more than 8,000 accounting professionals each year9.

- Technology: bookkeepers and accountants are among the leading professions for embracing cloud-based solutions in recent years. The migration to cloud-based accounting is allowing offshore talent to access and share financial data whenever and wherever they want, with the industry continuing to launch and update software and systems that provide benefits such as cost savings and enhanced user experience.

- Improved efficiencies: why go it alone on the accounting and bookkeeping front when specialist offshore providers have streamlined processes in place? This ability to deliver improved efficiencies is a blessing for businesses and allows them to focus on what they do best while leaving their accounting and bookkeeping needs to outsourcing firms that have tried and tested systems.

- Staff retention: outsourcing has the ability to not only improve accounting and bookkeeping processes but deliver a morale boost to wider staff. By freeing up onshore teams to concentrate on tasks that drive growth (eg: nurturing client relationships) or work at a more manageable pace, the business strategy has been proven to reduce staff turnover and ultimately save organizations the time and money needed to find new talent.

- Accurate financial reports: outsourcing providers have a vested interest in offering high quality services, which is great news for the businesses that partner with them. Their very livelihood depends on delivering work that is of a top standard and that is why the best of them invest heavily in nurturing highly qualified accountants and bookkeepers that can raise the bar when it comes to accuracy, productivity and adherence to compliance.

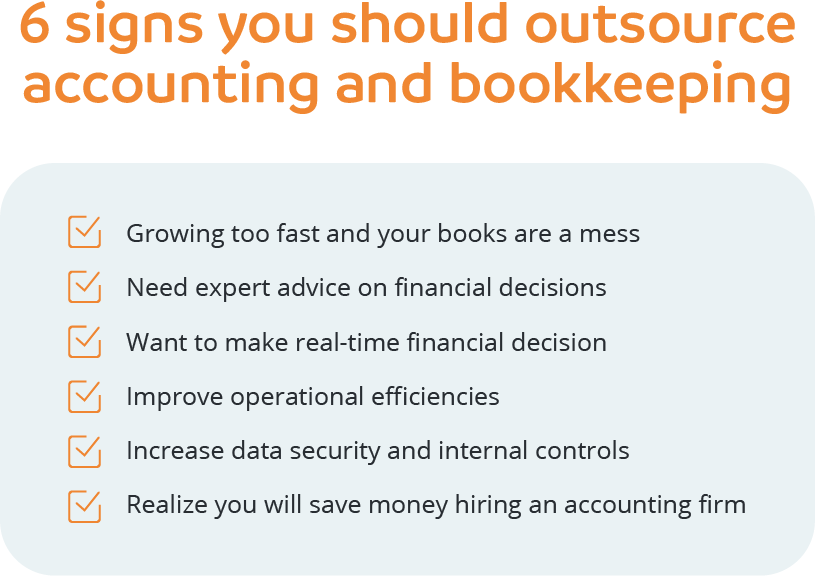

Source: Infographic: Are You Ready to Outsource Your Accounting Department? (smithschafer.com)

What accounting and bookkeeping roles can be outsourced?

The days when outsourcing was primarily about call centers and data entry are over. The modern outsourcing provider has access to team members who have leading qualifications and unrivaled industry expertise. This is especially so in the accounting and bookkeeping field, with the number of roles that can be outsourced including:

- Accountant

- Bookkeeper

- Auditor

- Accounts Receivable/Payable Specialists

- Accounting Supervisor/Manager

- Billing Specialist

- Finance Specialist

- Financial Analyst

- Financial Advisor

- Investment Manager

- Taxation Specialist.

Is outsourcing accounting and bookkeeping for you?

Despite its obvious benefits, partnering with an outsourcing provider for the first time can be a difficult decision. No two organizations are the same and that is why it pays to take time to consider one’s situation before rushing to join forces with the first offshore firm that comes along. When it comes to accounting and bookkeeping, there are various signs that the time is right to look for external assistance.

- Looking after your own bookkeeping is taking more time than you can afford

- Your financial records are never up to date

- You are spending more than you can afford on in-house accounting support

- You are struggling to recruit a full-time accountant or bookkeeper

- Staff are disgruntled about being forced to be ad hoc bookkeepers

- Sales have increased but your profits haven’t

- You are not realizing the full benefits of tax deductions

- You are concerned about not meeting regulatory requirements.

This is only the beginning. There are various other reasons to consider outsourcing accounting and bookkeeping services and the great news is that once the decision has been made to do so, there are many excellent providers ready and waiting to deliver the benefits outlined above.

The accounting skills shortage is taking a toll across the globe but one offshore provider is going the extra mile to help clients address the concern. Discover the tailor-made program providing pre-qualified candidates with the skills they need to perform in specific accounting environments.

Reference:

[1] Navigating the Accounting Talent Shortage: Strategies for Business Growth and Efficiency - FEI (financialexecutives.org)

[2] The CPA Shortage (shrm.org)

[3] The Benefits Of Outsourcing Finance And Accounting (forbes.com)

[4] (24) Unlocking the Power of Outsourcing: Why Accountants Choose Accounting and Bookkeeping Services | LinkedIn

[5] 50 Interesting Outsourcing Statistics [Updated for 2024] (weareamnet.com)

[6] 47 New Outsourcing Statistics (2023-2026) (explodingtopics.com)

[7] Finance and Accounting Outsourcing Trends to Watch in 2023 - Auxis

[8] Reduce operational costs with our outsourcing services (microsourcing.com)

[9] Differences Between Accountants in Different Countries - EIN Presswire (einnews.com)

Popular posts

Sign up for the offshoring eCourse

12 in-depth and educational modules delivered via email – for free

Related Posts

Surviving the accounting busy season: an all-inclusive guide

The infamous peak seasons for accountants. You know, those times of the year when coffee becomes your best friend and the office practically turns..

How to outsource bookkeeping

Ask anyone who has launched a small business and they will remember how exciting the early days were. Amid the expected stresses and pressures, there..

How AI is impacting the accounting and finance sector

As a leading think tank, the Thomson Reuters Institute has a proud history of igniting conversation and debate among the tax and accounting..