How to outsource bookkeeping

Ask anyone who has launched a small business and they will remember how exciting the early days were. Amid the expected stresses and pressures, there would have been a buzz from dedicating their energies to a passion project or using their unique skills to turn a dream into a reality. Sure, there would have been corporate boxes to be ticked – a bit of social media promotion, maybe some bookkeeping - but most of their time would have been spent doing what they love or are best at doing.

Then, as small businesses turn into bigger businesses, things tend to change for owners, managers and their staff. More administration, more boxes to tick and ultimately less time to spend on the tasks that bring them the greatest joy. Modern technology has made it easier and cheaper than ever for budding entrepreneurs to build their own websites, market their businesses and manage their finances but there inevitably comes a point when doing it all on their own is not the best use of their time, let alone their employees.

This is where outsourcing comes into play and few tasks are better suited for being managed by external partners than bookkeeping.

What is outsourcing bookkeeping?

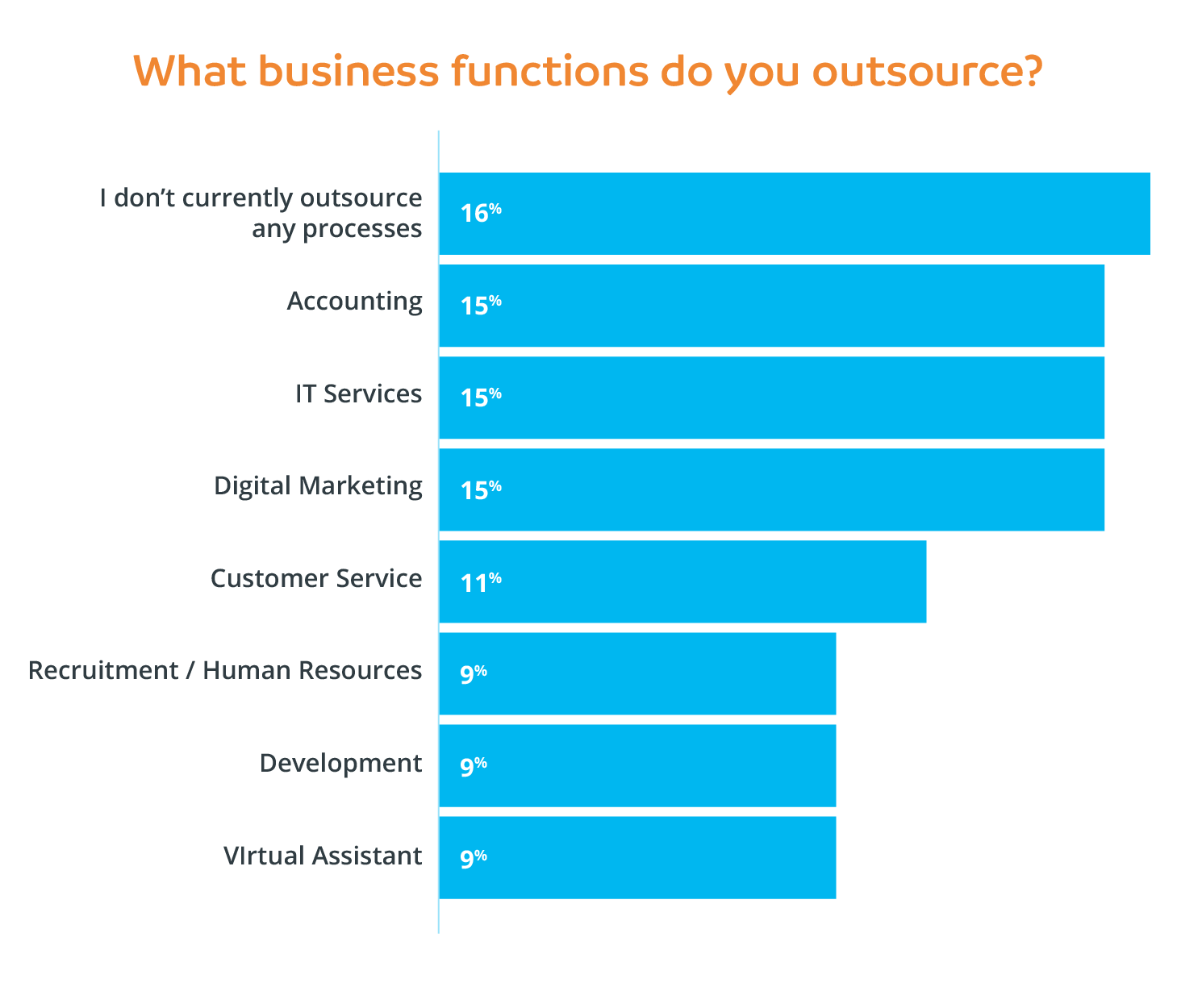

Outsourcing bookkeeping is the act of assigning selected accountancy-related tasks to a third party, often in an offshore location such as the Philippines. Along with delivering substantial cost savings, the strategy allows organizations of all sizes to focus on their core business and their in-house teams to spend more time on valuable and rewarding tasks that grow revenues. Outsourcing providers can assist with bookkeeping activities such as weekly and monthly reporting in XERO, payroll, accounts payable and receivable, tax compliance and general data processing. Various studies have highlighted the growing demand for outsourced bookkeeping, with findings such as:

- More than a third of small businesses outsource their accounting function.1

- 30% of small businesses think they overpay their taxes and are unable to manage their finances properly.2

- 57% of businesses outsource bookkeeping to focus on core functions, while 17% do so to expand and speed up organizational transformation.3

- Outsourcing bookkeeping to offshore destinations such as the Philippines can reduce labor costs by up to 70%.4

When to outsource bookkeeping services?

There is no definitive timeframe for outsourcing bookkeeping but there are several signs that it is a strategy worth considering.

- Lack of time: as a business grows, so does the amount of time required to track and record the likes of financial transactions, payroll and taxation. If you find yourself or your staff spending more time on ‘the books’ than the business itself, it is likely time to explore outsourcing bookkeeping.

- Increasing labor expenses: many businesses go down the path of hiring an in-house bookkeeper to manage their financial affairs. Many businesses also discover the cost of doing so (e.g. recruitment, wages, equipment) is not ideal, especially when compared to partnering with an offshore provider.

- Staff impact: modern accounting software has created an environment where bookkeeping tasks are often handed to existing staff. Along with the risk of inaccurate reporting, such team members often begrudge being required to complete a role that is outside their remit and area of expertise.

- Access to figures: there are few things worse in business life than not being able to access vital financial data at the exact moment you need it. If that sounds familiar, a quality outsourced bookkeeper will ensure such information is up to date and only a phone call or email away.

- Mistakes and discrepancies: looking after your bookkeeping may seem like a great idea … right up until you or your unqualified or overworked team member makes a costly or embarrassing error. Outsourcing providers have a vested interest in not only getting it right but getting it right every time.

Types of outsourced bookkeeping services

Businesses have several options when partnering with an outsourced bookkeeper.

- Local bookkeeper: a local bookkeeper is an individual or team that plies their trade in the same geographic area as their clients. While a Google search may reveal a range of such freelancers and firms, the quality and accuracy of their work has been known to vary dramatically while the better talents tend to have full client loads that restrict their ability to take on new work and often charge higher prices.

- Virtual bookkeeper: in a world that is more digitally connected than ever, it goes without saying that businesses have the option of using a virtual bookkeeper. By accessing a client’s bookkeeping software, server, documents and other data, the ‘faceless’ agent manages their books and finances but delays in communication, security concerns and a lack of specific industry knowledge is often cited as cause for concern.

- Offshore bookkeeper: tapping into a global talent pool at labor cost savings of up to 70% is proving a winner for many businesses when it comes to outsourcing bookkeeping. Quality providers pride themselves on nurturing talent pools filled with fully qualified CA and CPA accountants, establishing seamless communication protocols and employing the latest technology and security measures.

Source: Small Business Outsourcing Statistics: A Deep Dive into 2022 | UpCity

How do you ensure a quality outsourcing partnership?

Like any relationship, it takes time and effort to foster a quality partnership with an offshore bookkeeper. Here are a few tips to keep in mind.

- Finding a bookkeeper: this is best done through an outsourcing provider that understands the local market and culture of the offshore location. They will also have established systems for identifying, interviewing and onboarding talent, along with paying for the likes of staff wages, IT set-up and support, office infrastructure and security. While you will be involved in determining roles and responsibilities, the outsourcing provider will handle the pressure of narrowing the selection of candidates.

- Training a bookkeeper: one of the joys of partnering with an outsourcing provider is they will assist with this time-consuming process. Better still, they will have a range of proven tips and techniques based on their industry experience. One of the most important aspects of the training process is establishing the technology, documentation and communication processes that your bookkeeper needs to thrive in their role and quality offshore providers will once again ensure such boxes are ticked as a matter of course.

- Working with a bookkeeper: it is now time to get to work and a great tip is to reflect on how you would manage in-house staff and apply similar procedures. Progress meetings and setting clear expectations on deliverables is essential, while focusing on morale and inclusion will go a long way towards making your offshore bookkeeper feel further invested within your team. Ensure they feel comfortable asking questions and provide regular feedback. Best of all, your outsourcing provider will take the lead on these areas to ensure you will not only be glad that you outsource your bookkeeping needs but wonder why you did not do so sooner.

Summary

Bookkeeping may seem like a small task when growing a business but there inevitably comes a tipping point when that is certainly not the case. Keeping up with changing regulations, dealing with peak seasons and maintaining pace with technology are just a few of the factors that can turn that ‘small task’ into a major headache. Fortunately, there is a proven remedy and it lies with outsourcing one’s bookkeeping needs.

Financial Planning and Analysis (FP&A) software is no longer a value-add but a must-have for organizations wanting to achieve their financial goals. Discover why businesses should invest in FP&A tools and how to choose the solutions that best suit your needs.

Reference:

[1] (7) BENEFITS OF OUTSOURCED ACCOUNTING AND BOOKKEEPING SERVICES | LinkedIn

[2] Nearly One-Third of Small Business Owners Believe They Overpay Their Taxes (prnewswire.com)

[3] Accounting Outsourcing Companies - Some Facts And Figures (outbooks.com.au)

[4] Why is Outsourced Accounting and Bookkeeping a Smart Choice for Small Businesses? (capactix.com)

Popular posts

Browse by topic

- Accounting

- Accounting & Finance

- All Industries

- Banking

- BPO/RPO/HRO

- Communication

- CSR & ESG

- Customer & Client Acquisition

- Customer Experience

- Cybersecurity

- Cybersecurity & Compliance

- Data Management

- Digital Operations

- Digital Transformation

- eCommerce

- Education

- Employee Engagement

- Engineering & Construction

- Financial Services

- Healthcare

- Hospitality and tourism

- HR & Recruitment

- Information Technology

- Insurance

- Legal Services

- Logistics

- Offshoring & Outsourcing

- Outsourcing

- Professional Services

- Real Estate

- Retail & eCommerce

- Startups

- Talent Acquisition and Retention

- Technology

- Trends & Guides

- Workforce Integration

Related Posts

How employers can reduce healthcare costs

A lot has been written about how the working world has changed in the wake of the COVID-19 pandemic. Where many managers once linked productivity..

Defining data – the difference between data privacy, data security and data protection

There is no shortage of issues that can inspire sleepless nights for business leaders. Talent shortages, regulatory pressures, shrinking budgets and..

Is offshore staffing the key to data compliance?

With entire websites dedicated to exposing businesses daily that have been hacked or have had their data breached daily, it’s no wonder why data..