Ultimate guide to FP&A tools – benefits, buyer’s tips and best options

Financial planning has long been an integral component of business life. The ability to access the risks and opportunities that an organization faces is crucial for senior managers, not to mention breakdowns of individual departments at the most granular level. In some ways, it is not unlike being able to look into a crystal ball when weighing up the next steps for the firm.

.jpg?width=705&height=480&name=M_BlogT_A-guide-to-fpa-the-best-tools%20(1).jpg)

Given its worth, it is no surprise that an entire industry has emerged to support the people charged with providing such insights. The Financial Planning and Analysis (FP&A) software market was valued at $3.7 billion in 2021 and is predicted to reach $16.9 billion by 20311 as executives strive to dig deeper into the financial operations of their businesses. FP&A tools and solutions provide valuable assistance with financial planning, forecasting and budgeting processes that can help leadership teams make important business decisions.

FP&A tools are no longer a ‘value-add’ but a ‘must-have’ for organizations wanting to maintain fiscal health and stay on track to achieve their financial goals. Making data-driven decisions can significantly impact one’s bottom line and FP&A solutions not only tap into such data but present it in a manner that allows businesses to create more accurate financial forecasts, mitigate risks and pinpoint growth opportunities.

What is FP&A?

Financial planning and analysis (FP&A) refers to the processes designed to help businesses accurately plan, forecast and budget to support their major business decisions and future financial health. At a more specific level, global consulting firm Gartner breaks the field into a set of four activities – planning and budgeting, integrated financial planning, management and performance reporting, forecasting and modeling.

How do FP&A teams operate?

FP&A staff or teams are required to coordinate and collaborate with department heads across an entire organization to ensure they access and maintain an accurate reflection of the financial data on offer. Along with analyzing fiscal performance, they run models of potential plans to influence decisions, create periodic financial reports and deliver strategic recommendations. Where this was historically done via manual processes, the tech revolution has seen a proliferation of digital solutions that allow FP&A teams to work faster, more efficiently and with greater accuracy than ever before.

What are FP&A tools?

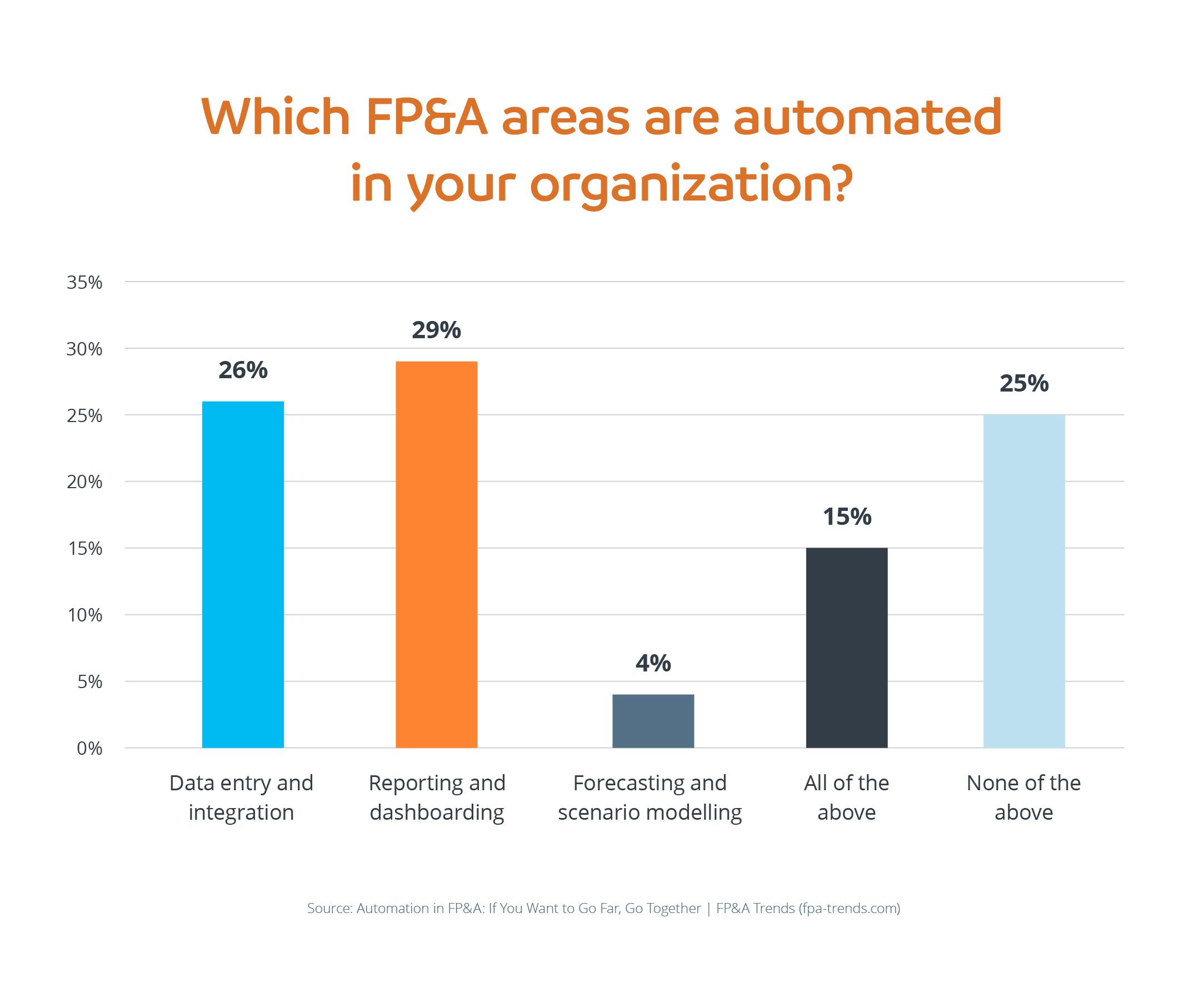

FP&A tools are software solutions that help finance professionals manage and analyze financial data. Such work was traditionally executed via a series of complex and connected spreadsheets2 but modern FP&A tools are designed to automate many repetitive tasks such as data entry, data consolidation and report generation. In turn, this allows finance teams to dedicate more time and focus to strategic activities such as data analysis and forecasting.

Crucially, FP&A tools have been designed to cater for different needs. Some suit small businesses, while others are targeted directly at large enterprises. There are those that operate in the cloud and many that are installed on-premises. Some are designed for specific industries, while others are more for general use. The key is that with tools coming in many different shapes and sizes, there is every opportunity to find the FP&A solution that works best for your organization.

Why should businesses invest in FP&A tools?

Between an increasingly complex business landscape3 and uncertain economic outlook4, it has never been more important to have a clear picture of one’s financial position and opportunities. With that in mind, there has never been more reason to invest in FP&A tools.

- Make data-led decisions more quickly: imagine you need to make a business decision. Option one involves chasing information from department heads or key stakeholders from different parts of your organization. Option two sees leaders handed relevant and insightful data from one source in a neat bundle. The latter is a reality thanks to FP&A tools, with leadership teams able to consult their finance teams or software when they need information to support a possible project or gain general insights. Put simply – more efficient decisions backed by solid and reliable data.

- Grow your business sustainably: FP&A tools do much more than support immediate business decisions. Long-range forecasting is a tricky business but with quality software, FP&A teams can create business models, projections and even predict outcomes across a range of departments. By establishing scenario models based on curated data, they can compare multiple outcomes and provide management teams with the guidance they need to make the best decisions to help optimize business growth.

- Increase productivity and efficiency: a fully automated FP&A process means financial teams can produce insightful data interpretations without needing to involve as many colleagues in the process. Less emails chasing information, less interruptions for busy people, less need to store or maintain documents. Concentrating business planning processes in one area and with the support of digital solutions is a fast-track to increasing productivity and efficiencies, not to mention a lot more cost-effective due to decreased staffing requirements.

How do you choose the right FP&A tools?

Like so many aspects of the digital world, navigating the wide range of FP&A tools on offer can be a challenge. Between changing needs, increasing complexities and emerging innovations, it is essential to consider various factors when choosing an FP&A solution.

- Data integration and connectivity: accuracy and consistency are non-negotiables for FP&A teams and that means using a robust tool that can integrate with existing systems and data sources. Be it enterprise resource planning (ERP), customer relationship management (CRM) or other data sources, seamless connectivity will help streamline workflows and improve efficiencies, while tools also need to be able to manage sizable volumes of data without sacrificing accuracy or speed.

- Forecasting and budgeting capabilities: one of the key tasks of any FP&A team is to create accurate financial models and budgets for any number of scenarios, thus allowing organizational leaders to plan for potential changes in the business landscape. The best tools feature machine learning and artificial intelligence technologies that improve the quality of such forecasts and help businesses stay ahead of their rivals. The ability to handle complex financial calculations and deliver real-time updates are also high on the wish list.

- Reporting and visualizations: it is one thing to access key information. It is another to communicate often complex financial data to stakeholders clearly and quickly. Look for FP&A tools that incorporate customizable reporting options such as dashboards, charts, graphs and tables that allow colleagues to easily interpret and understand financial insights. There are also options that make it simple for users to identify trends by drilling into data at the touch of a button.

- Security and compliance: few things are more sensitive for a business than its financial information, which is why security and compliance should be of the utmost importance when acquiring an FP&A tool. The likes of advanced data protection, encryption, access controls and compliance with industry standards should be high priorities. Multi-factor authentication5 is another feature that can ensure only the right people have access to sensitive financial data.

The top five FP&A tools for 2023

Now that you have a better understanding of what to look for in an FP&A tool, here is a selection of the best options to help your business in 2023.

-

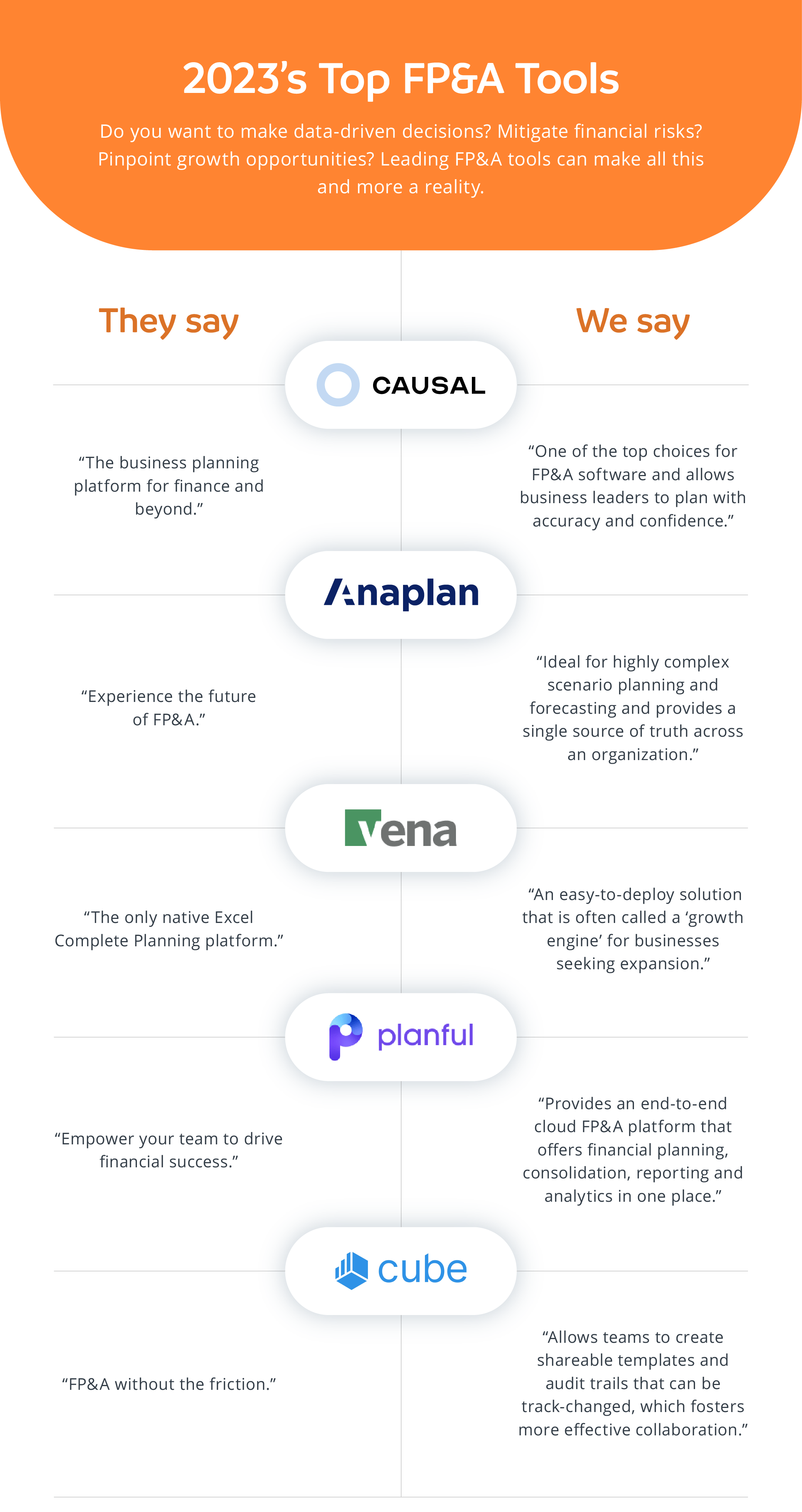

Causal

A flexible business planning platform with a dynamic modeling engine, Causal has established itself as one of the top choices for FP&A software. It is an intuitive platform built for modern companies, ranging from start-ups to IPO, and allows business leaders to plan with accuracy and confidence. Key features include one of the most powerful modeling engines in the industry and the ability to write and run multiple scenarios in three clicks to effectively compare different hiring, growth and revenue plans. Oh, and don’t forget users can automate and distribute models and reports within an hour of signing up. -

Anaplan

Focused on enterprise-level companies, Anaplan is ideal for highly complex scenario planning and forecasting. The platform can connect multiple sources of data and team members, allowing for a single source of truth across an organization and ensuring better planning and outcomes. Along with budgeting, forecasting, specialty financial planning and operation planning, Anaplan includes automation that helps with cost management and supports easier and faster decision-making. One point worth noting is it requires more IT support than some solutions so it may be the best option for businesses with limited tech budgets. -

Vena

A single, web-based solution, Vena leverages users’ existing Excel spreadsheets and the company-specific models within them. With pre-built solutions designed to automate time-consuming tasks, the easy-to-deploy solution offers a range of capabilities including FP&A, integrated business planning, financial reporting and regulatory compliance reporting. With a strong focus on supporting growth, Vena is often called a ‘growth engine’ for businesses seeking expansion and provides valuable insights and actionable information. Keep in mind that it is not compatible with Mac and better suited to established organizations that want to keep using Excel’s familiar UI with the power of a supporting database.

-

Planful

Formerly known as Host Analytics, Planful provides an end-to-end cloud FP&A platform that offers financial planning, consolidation, reporting and analytics in one place and is accessible regardless of one’s location. If you are keen to automate and accelerate everyday processes, this may be the tool for you. By capturing financial results at a consolidated level, it acts as a single source of truth and makes it easy for finance, accounting and business teams to accelerate financial planning and reporting. A built-in workflow also provides a visual snapshot of work yet to be done and end dates can be customized to suit how and when you want to close the books.

-

Cube

Cube’s FP&A tool specializes in automating data inputs and reporting processes for mid-market companies. Along with advanced automation capabilities, it has a strong customer support offering that aims to ensure users can quickly resolve any issues. The software allows teams to create shareable templates and audit trails that can be track-changed, which fosters more effective collaboration. Cube prides itself on its user-friendly interface and ease of use, while its focus on leveraging effective KPIs means users can access valuable insights to inform decision-making.

Also consider …

- IBM Planning Analytics: an integrated planning solution that uses artificial intelligence (AI) to automate planning, budgeting and forecasting and drive more intelligent workflows.

- Jedox EMP Software: allows FP&A teams to plan, analyze and report on one integrated platform and is highly compatible with Microsoft solutions such as Excel, Power BI and Dynamics 365.

- Workday Adaptive Planning: serves as a cloud-only solution that supports financial planning, workforce planning, sales planning, operational planning, modeling, performance reporting, dashboards, analytics and collaboration.

- Oracle Cloud EPM: a SaaS Enterprise Performance Management platform for enterprise-level financial and operational planning, reporting, consolidation and close, and enterprise master data management.

- Prophix: an innovative, cloud-based Corporate Performance Management (CPM) software that automates budgeting, forecasting and reporting across multiple industries including manufacturing, retail, healthcare, hospitality and banking.

Summary

In the modern world, a Financial Planning and Analysis team is only as strong as the automation and cloud-based solutions they have at their disposal. Choosing which FP&A tools to invest in is a big decision but a little research can go a long way and deliver your business the technology it needs to maximize its potential.

From banking digitalization and online innovation to artificial intelligence, digital transformation is sweeping the financial landscape. Discover the top six digital banking trends likely to impact the sector this year.

Reference:

[1] Outlook on the Financial Planning Software Global Market to (globenewswire.com)

[2] Traditional FP&A is Failing. What's Next? - Anders CPAs + Advisors

[3] Operating In A Complex World Does Not Have To Be Complicated (forbes.com)

[4] World Economic Outlook Shows Economies Facing High Uncertainty (imf.org)

[5] Multi-Factor Authentication: Who Has It and How to Set It Up (pcmag.com)

Popular posts

Sign up for the offshoring eCourse

12 in-depth and educational modules delivered via email – for free

Related Posts

Surviving the accounting busy season: an all-inclusive guide

The infamous peak seasons for accountants. You know, those times of the year when coffee becomes your best friend and the office practically turns..

How to outsource bookkeeping

Ask anyone who has launched a small business and they will remember how exciting the early days were. Amid the expected stresses and pressures, there..

How AI is impacting the accounting and finance sector

As a leading think tank, the Thomson Reuters Institute has a proud history of igniting conversation and debate among the tax and accounting..