BPO market update: a plan for the future

It will come as no surprise for anyone who knows me that I am truly excited about what the next year will deliver for the Business Process Outsourcing (BPO) industry. As the Chief Executive Officer of MicroSourcing, I am blessed to lead the largest and leading provider of managed or hosted offshore services in the Philippines and am extremely passionate about not only the business itself but the sector in which I am proud to work.

As you can imagine, I am often asked how the BPO industry is placed or what is coming next and in recent times I have had a valuable resource at hand to support my views. Late last year, the IT & Business Process Association of the Philippines (IBPAP) unveiled its Industry Roadmap 2028, which serves as the blueprint for the sector’s priorities in digitization, talent, policy-shaping, infrastructure and country branding for the next six years. This includes a clear vision of the Philippines becoming the world’s number one experience hub for customer-centric and digitally enabled services.

Between my CEO duties and role as the head of IBPAP’s Talent, Attraction and Development group, I am fortunate to have an insider’s perspective of the BPO industry and believe there are several exciting developments and trends to watch for in 2023.

- Work from home – the COVID-19 pandemic changed the conversation around remote and hybrid work, with our company one of many to embrace the opportunity to reinvent how we operate. All our clients now have the flexibility to access work-from-home models and it is a huge factor in helping us attract the best talent. As highlighted in the IBPAP roadmap, the industry is predicting up to 80% of BPO staff will migrate to remote or hybrid work and, at MicroSourcing, we have proactively updated our government certification to reflect this.

As background, contact centers and BPOs have traditionally sought incentives from PEZA (Philippines Economic Zone Authority) but during the past year it issued a return-to-office mandate that meant any business with as few as five remote workers would not receive such benefits. Working with the government and industry associations, we influenced a ruling that PEZA-certified organizations can transfer their registrations to the Philippine Board of Investments (BOI), which awards incentives regardless of whether staff are in-center, hybrid or working from home – a win not only for BPOs but our clients.

- Countryside growth – as an industry group, IBPAP focuses on six sub-sectors including Global Shared Services, IT and Software, Healthcare, Animation and Game Development. Then there is the category that employs more than twice the number of people as those combined – Contact Center, with almost 1 million FTEs. As a director at the Contact Center Association of the Philippines (CCAP), I have a keen interest in Countryside Development (i.e: fostering more provincial workers) and it is pleasing to see IBPAP make a similar commitment in its latest roadmap.

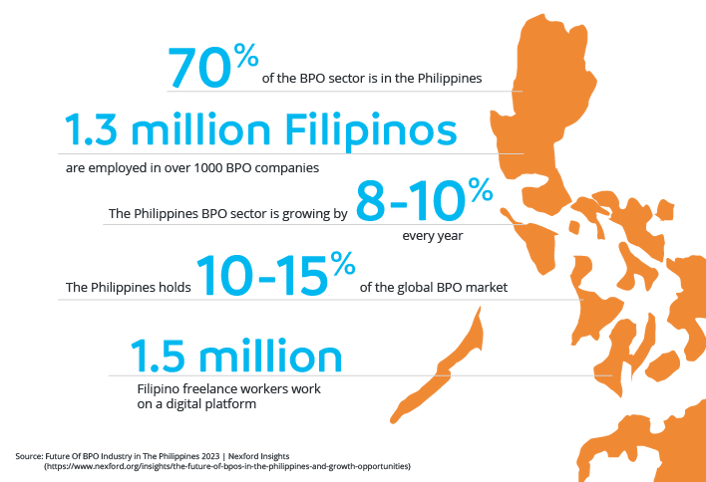

With an estimated growth rate of 8.5%, it revealed the industry is expected to create up to 1.1 million direct jobs in the next six years and has declared that 54% will be in the countryside1. About 30% of the BPO workforce relocated to the countryside due to the pandemic2 and I would love to see that number soar to generate opportunities for both workers and clients in untapped markets. Our company has already opened sites in Cebu, with about 600 FTEs now in the provinces – or more than 10% of our workforce – and this number will rise in coming years. - AI everywhere – as the COVID-19 crisis swept the world in 2020, BPOs rushed to deploy technologies aimed at easing the burden and, in doing so, helped drive the global market for artificial intelligence (AI) in the sector to $1.1 billion3. That figure is projected to reach $3.5 billion by 20264 as companies such as ours continue to look for ways to use AI to reduce costs and increase efficiencies while providing better customer experience. Conversational AI is emerging as a key trend in the contact center industry, with its ability to automate customer service and boost revenues for providers and clients alike.

- Investment in cyber infrastructure – at a time when data protection is top of mind for many businesses, it goes without saying that BPO providers are similarly committed to investing in protecting themselves and their clients from security threats. A study by Deloitte found 64% of businesses plan to invest in security capabilities to combat such concerns and ensure the reliability of their infrastructure5 and we know better than anyone that strengthening cyber security is critical to earning the trust of our clients. From utilizing multi-factor authentication to meeting compliance regulations, this is one trend that is here to stay.

Summary

Rarely a day has gone by in the past couple of decades when I have not felt fortunate to have made a career in the BPO industry but that is particularly so now. From the unlimited potential of the technology we use to the societal revolution of how and where our people work, the future is looking incredibly bright. Outsourcing has never been a more fast-paced sector and as we adapt to global challenges and embrace new trends, it is great to know the impact we are having on so many businesses across the globe.

There has been a lot of hype about the Philippines gig economy in recent times but some onshore businesses are ending up frustrated, disillusioned or out of pocket? Learn why there is a big difference between partnering with an established outsourcing provider and teaming with an independent freelancer.

Updated February 2023

Reference:

[1] IBPAP projects 1.1-million direct countryside jobs in next 6 years | Andrea E. San Juan (businessmirror.com.ph)

[2] BPOs hope to ride WFH wave by expanding to countryside - BusinessWorld Online (bworldonline.com)

[3] What to Expect in BPO Industry this Coming 2023? - Flexisource (flexisourceit.com.au)

[4] Global Call Centers Artificial Intelligence (AI) Market Trajectory & Analytics, 2020-2021 & 2022-2026 - ResearchAndMarkets.com | Business Wire

[5] Deloitte Global 2021 Future of Cyber Survey

Popular posts

Browse by topic

- Accounting

- Accounting & Finance

- All Industries

- Banking

- BPO/RPO/HRO

- Communication

- CSR & ESG

- Customer & Client Acquisition

- Customer Experience

- Cybersecurity

- Cybersecurity & Compliance

- Data Management

- Digital Operations

- Digital Transformation

- eCommerce

- Education

- Employee Engagement

- Engineering & Construction

- Financial Services

- Healthcare

- Hospitality and tourism

- HR & Recruitment

- Information Technology

- Insurance

- Legal Services

- Logistics

- Offshoring & Outsourcing

- Outsourcing

- Professional Services

- Real Estate

- Retail & eCommerce

- Startups

- Talent Acquisition and Retention

- Technology

- Trends & Guides

- Workforce Integration

Related Posts

How employers can reduce healthcare costs

A lot has been written about how the working world has changed in the wake of the COVID-19 pandemic. Where many managers once linked productivity..

Defining data – the difference between data privacy, data security and data protection

There is no shortage of issues that can inspire sleepless nights for business leaders. Talent shortages, regulatory pressures, shrinking budgets and..

Is offshore staffing the key to data compliance?

With entire websites dedicated to exposing businesses daily that have been hacked or have had their data breached daily, it’s no wonder why data..