The future of healthcare delivery in the U.S.

- Home

- The future of healthcare delivery in the U.S.

If the COVID-19 pandemic reinforced anything, it is the ability of the U.S. healthcare system to rise to the challenge in times of extreme hardship. As the worst of the crisis unfolded, it was inspiring to see clinicians, executives and administrators work tirelessly to care for the public, adapt to unique circumstances and find new ways to work together for the greater good.

And that is just as well because fresh challenges abound.

While the COVID-19 threat has eased, U.S. hospitals and health providers are facing a number of issues that will require a stronger, more flexible and productive healthcare system. From inflation and labor shortages to consumers who are no longer willing to play a passive role in their healthcare process, it is more important than ever for health executives to be agile and progressive when it comes to tackling such issues. Then there is the looming impact of a pandemic hangover, with McKinsey predicting U.S. healthcare expenditures will rise by $600 billion by 2027 - $220 billion from COVID-19 alone.

Responding to such challenges begins with identifying them and, on that note, here are the likely trends that will influence the U.S. healthcare sector into the near future.

-

Digital health solutions

Any hospital or health service yet to board the digital health train would be well advised to hurry up and buy a ticket because they will be left behind – if they haven’t been already. Virtual healthcare delivery is changing the face of the sector, with the likes of telehealth, at-home testing and prescription delivery services revolutionizing patients’ ability to receive quality care and manage their health. A trend that was always destined to happen, it was expedited by the pandemic and digital strategies need to be a key priority for the sector.

Despite record-breaking digital health investment in recent years ($29.1 billion in 2021 alone), challenges such as saturated markets, insurance coverage issues and data privacy concerns have caused headaches for healthcare services and it is likely that digital health technologies are set to face higher scrutiny in the coming year. This includes their ability to measure success and showcase differentiated value but there is no doubt there is a thirst for new solutions. This is particularly so for technologies that focus on expanding access to integrated care and generating data that can improve public health. -

Productivity pressures

The U.S. healthcare system is not alone in yearning for operational gains but there is evidence to suggest productivity growth has been particularly slow for the sector. Look for health leaders to increasingly prioritise streamlining operations for increased efficiencies, with reductions in team sizes and restructuring just two strategies likely to appear in an increasing number of health headlines. Amid cashflow pressures and the need for leaner organizational structures, it would be no surprise to see this trend to continue in the coming year.

While clinical teams account for the majority of health service costs, there is also enormous scope to reduce administrative expenses without affecting quality or access. Ongoing investment in automation is likely as hospitals and healthcare providers look to streamline activities, with examples including automated staffing and scheduling tools, strategic payer-provider platforms to improve sharing of information and automating repetitive processes in HR and finance. -

Entry of non-traditional players

Some are in it for the money. Others have more altruistic motivations. Then there is the demand for more consumer-driven care. Whatever the reason, there is a significant rise in non-traditional players entering the healthcare ‘business’. Technology and consumer-focused companies are making inroads into the market and traditional operators should be prepared for disruption, especially given the newcomers’ deep understanding of data analytics and virtual capabilities. There is also a rise in entrants from industries such as retail, telecommunications, technology, wellness and fitness, with their products and services helping to democratize and decentralize healthcare.

A prime example is consumer electronics giant Best Buy, which is investing in healthcare companies and setting up medical and health equipment in patients’ homes. The company acquired Current Health for $400 million in 2021, won over by the tech platform’s ability to bring together patient monitoring, telehealth and patient engagement, while it also paid an undisclosed sum in Coeus. health, a remote patient monitoring company. Ride-share company Lyft has also entered the sector, launching Lyft Healthcare to provide transportation for patients needing to attend medical appointments. -

Health data driving personalized care

As with most industries, consumers are expecting - and demanding - a seamless, personalized and integrated experience when it comes to their healthcare. The average patient is no longer willing to play a passive role in their healthcare and many U.S. hospitals and providers are responding by moving away from a traditional insurance-based, profit-driven model to a value-based system that puts people before profits and shareholders.

Given this move to patient-centered care, access to health data has fast become one of the leading trends for the healthcare sector. With research showing that personalized care can improve health outcomes, boost provider-patient relationships and reduce costs, the key to achieving such goals starts by leveraging patient data – and that requires easy access to reliable information.

The trouble for health services is that such insights have traditionally been spread across multiple systems, which is why one can expect an increasing emphasis on solutions that tackle data access concerns. Centralized hubs such as the National Directory of Health Care Providers and Services not only improve platform interoperability and support personalized medicine but will enable more accurate risk assessments and patient evaluations, ultimately paving the way for better value-based care models. -

Navigating a workforce crisis

HR headaches do not come much bigger. As reported in Deloitte’s 2023 Global Health Care Outlook, the worldwide health care sector will need an estimated 80 million more workers to meet demand by 2030. At the same time, doctors and nurses are increasingly saying they plan to reduce their work hours, with one in four U.S. physicians and two in five nurses saying they intend to leave the sector altogether. It is no better in the UK where the attrition rate for hospital workers rose from 18% to 26% in 2021.

Burnout was already a hot topic among healthcare workers before the pandemic, let alone during the crisis, and it continues to cause concern. An International Council of Nurses policy brief revealed about 90% of nurse associations believe the likes of heavy workloads, resource shortages and burnout will drive more staff from the profession.

What was a concern prior to COVID-19 has become a crisis in its wake and health executives are under extreme pressure to find solutions to ensure the delivery of the right services when and where they are needed. While talk of social phenomena such as ‘The Great Resignation’ and ‘Quiet Quitting’ has eased in the past year, health services continue to face difficulties recruiting and retaining skilled clinical and administrative talent and that challenge looks likely to grow.

Amid such pressures, organizations need to reconsider their resourcing strategies. This could involve paying starting bonuses or considering alternative resourcing strategies such as offshoring as a way that organizations can access a global pool of quality talent while reducing employment costs by up to 70% in the process. The sector is also seeing working models where doctors and other healthcare professionals are working across multiple sites and collaborating with other providers.

Healthcare organizations need to consider how emerging technology can offer the necessary support for overworked healthcare staff. Artificial intelligence (AI) that can analyse patient data and provide actionable insights can decrease administrative healthcare times significantly. Take for example newly developed imaging AI that can scan the patient and effectively identify abnormalities in such scans or even AI software that can manage the flow of patients in an emergency room.

In addition, physicians are worried they are spending too much time on documenting patient data rather than clinical care so it is clear that process changes and employment restructures need to be a part of any future strategic plans for providers.

Changing revenue models

Along with influencing the state of healthcare in the U.S., these factors are also impacting the overall revenue and cost structures for many providers. These include:

- Investment required in new technologies and legacy systems that require upgrades

- Value-based service models changing revenue streams

- New competitors entering the market with access to and expertise in new technology

- Transition to virtual health options which require investment and will change revenue streams

- Time-consuming reconciliation processes between new and existing accounting and payment systems

- A more discerning and demanding consumer driving change in delivery and cost.

As a result, U.S. healthcare providers will not only need to secure their revenue streams and structures in this ever-changing environment but also look at innovative ways to reduce costs. By doing this, providers can free up capital to invest in and streamline their processes to ensure they are working as efficiently as possible.

As Deloitte notes in its 2023 Global Health Care Outlook: “If the health sector takes advantage of these opportunities, it could transform care delivery, the patient experience and ways of working at hospitals and other facilities, while also reducing inequities and boosting resiliency.”

A rethinking of resources

With so many technological, financial and human resources challenges in store for the future of the U.S. healthcare sector, a new way of resourcing might well be part of the solution. Offshore outsourcing gives companies access to cost-effective, qualified talent who can assist in a number of ways.

Firstly, high-volume, time-consuming work such as payment reconciliations can be outsourced in order to free up key medical and administration staff for core healthcare work. There is also an opportunity to engage with offshore staff to implement personalized communications with patients such as care follow-ups and reminders.

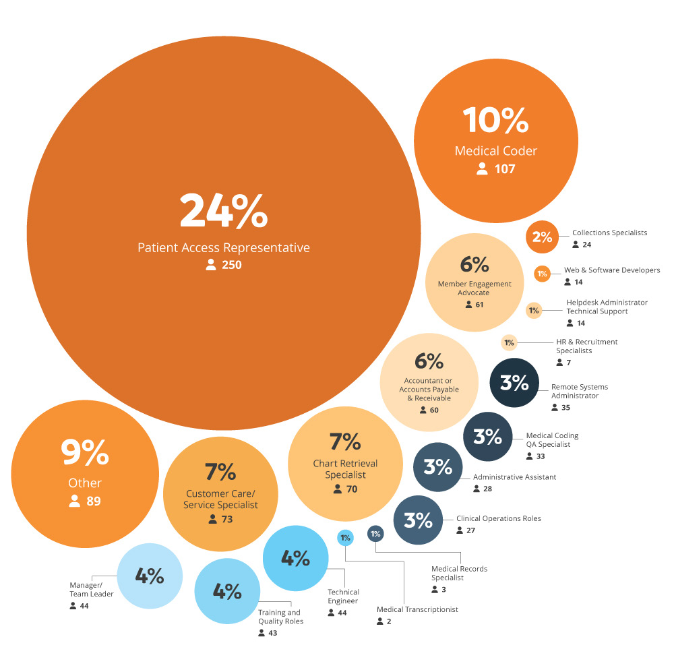

What’s more, an outsourcing hotspot such as the Philippines produces tens of thousands of highly skilled nursing graduates each year, many of whom embrace the chance to support U.S. clients. Roles currently fulfilled through MicroSourcing for a number of healthcare providers include:

% of total MicroSourcing roles with U.S. healthcare clients.

U.S. healthcare providers may also need to look outside the country to the global talent pool in order to fulfill some of the technological development requirements needed in the coming years. This would include API development, system integrations, virtual platforms, automation and AI. Developers and coding talent in the U.S. are already in high demand so a more cost-effective solution with almost unlimited availability is an option worth considering for healthcare providers that are facing an increasingly competitive market.

Medical credentialing company reduces processing times by 27% and costs by 63%

A progressive medical credentialing company. More than 600 healthcare clients across the U.S. The challenge to scale quickly while managing costs. Discover how partnering with MicroSourcing resulted in an offshore team in the Philippines that has reduced processing times by 27% and costs by 63%.

Learn more

Medical record retrieval service reduces per-unit production costs by 40%

A leading provider of national medical record retrieval services. A strong client base with many long-term contracts in place. Increasing financial headaches due to the high cost of U.S. labor. Discover how partnering with MicroSourcing reduced per-unit production costs by more than 40% and made existing contracts profitable again.

Learn moreAs with many industries worldwide, consumers are becoming increasingly educated and discerning. They are expecting personalized, integrated and cost-effective outcomes via digital platforms for every aspect of their lives. That includes healthcare and when combined with a transition to value-based services and increasing competition, the U.S. healthcare industry is in need of fast and dramatic innovations in areas such as virtual care and digital health records to cost-effectively achieve their goals.

Offshore outsourcing can assist in easing the burden of administrative work associated with healthcare delivery. By employing offshore, healthcare providers can achieve savings of up to 70% when compared to employing U.S. based staff. What’s more, offshore outsourcing opens up a global pool of talent in other more technical areas of employment to assist with the digital transformation that is currently taking place in the sector.

MicroSourcing alone provides more than 1,700 specialist resources to the U.S. health sector, from leading healthcare providers and payers to medical start-ups at the beginning of their journeys. With expertise in tasks including revenue cycle management, contact center, patient access, quality assurance, medical coding, IT support, finance, accounting and high-volume back-office roles, our dedicated talent acquisition team is highly skilled at sourcing the right people and pairing them with leading technology to help clients deliver quality healthcare and optimize business processes all while easing financial pressures.

MicroSourcing can also support U.S. clients with HIPAA compliance and is ISO 27001 Information Security Management and ISO 9000 Quality Management Systems Certified, ensuring the safeguarding of both client and patient data.

Want to build a dedicated team in the Philippines?

Get in contact today, and we’ll get back to your inquiry within one business day.